LTV:CAC Ratio

What is LTV:CAC Ratio?

To understand the marketing KPI, LTV to CAC ratio, we first need to break down the two components: Lifetime Value (LTV) and Customer Acquisition Cost (CAC).

Lifetime Value (LTV), sometimes referred to as customer lifetime value, is the average revenue a single customer is predicted to generate over the duration of their account.

Customer Acquisition Cost (CAC) is the average expense of gaining a single customer.

The ratio of lifetime value to customer acquisition cost helps you determine how much you should be spending to acquire a customer. Calculating this ratio will show if you’re spending too much per customer or if you’re missing opportunities from not spending enough.

How to calculate LTV to CAC Ratio:

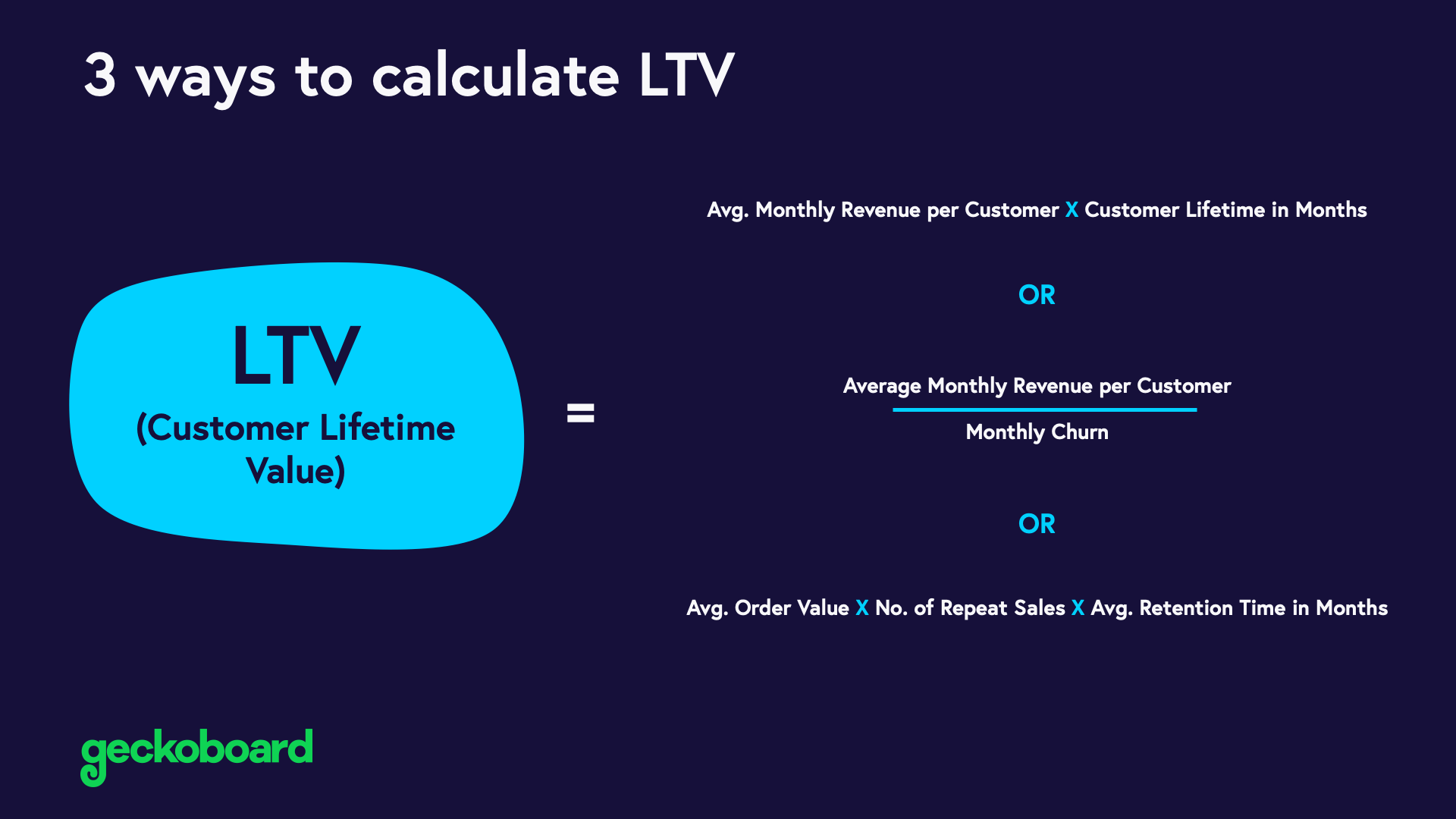

LTV can be calculated a couple different ways:

For SaaS companies:

($) Average monthly revenue per customer X (# months) customer lifetime = ($) LTV

Or

($) Average monthly revenue per customer / monthly churn = ($) LTV

For Ecommerce companies:

($) Average Order Value X (#) Repeat Sales X (# months) Average Retention Time = ($) LTV

For Mobile Apps (note that adding the referral value is optional):

($) Average revenue per user X (1/monthly churn) + ($) Referral value = ($) LTV

For a more precise calculation for LTV, use one of these formulas that factors in gross margin:

($) Average MRR per account X (1/monthly churn) X gross margin (%) = ($) LTV

Or

($) Average annual recurring revenue per account X (1/annual churn) X gross margin (%) = ($) LTV

Or

($) Average Order Value X (#) Repeat Sales X (# months) Average Retention Time X (%) gross margin = ($) LTV

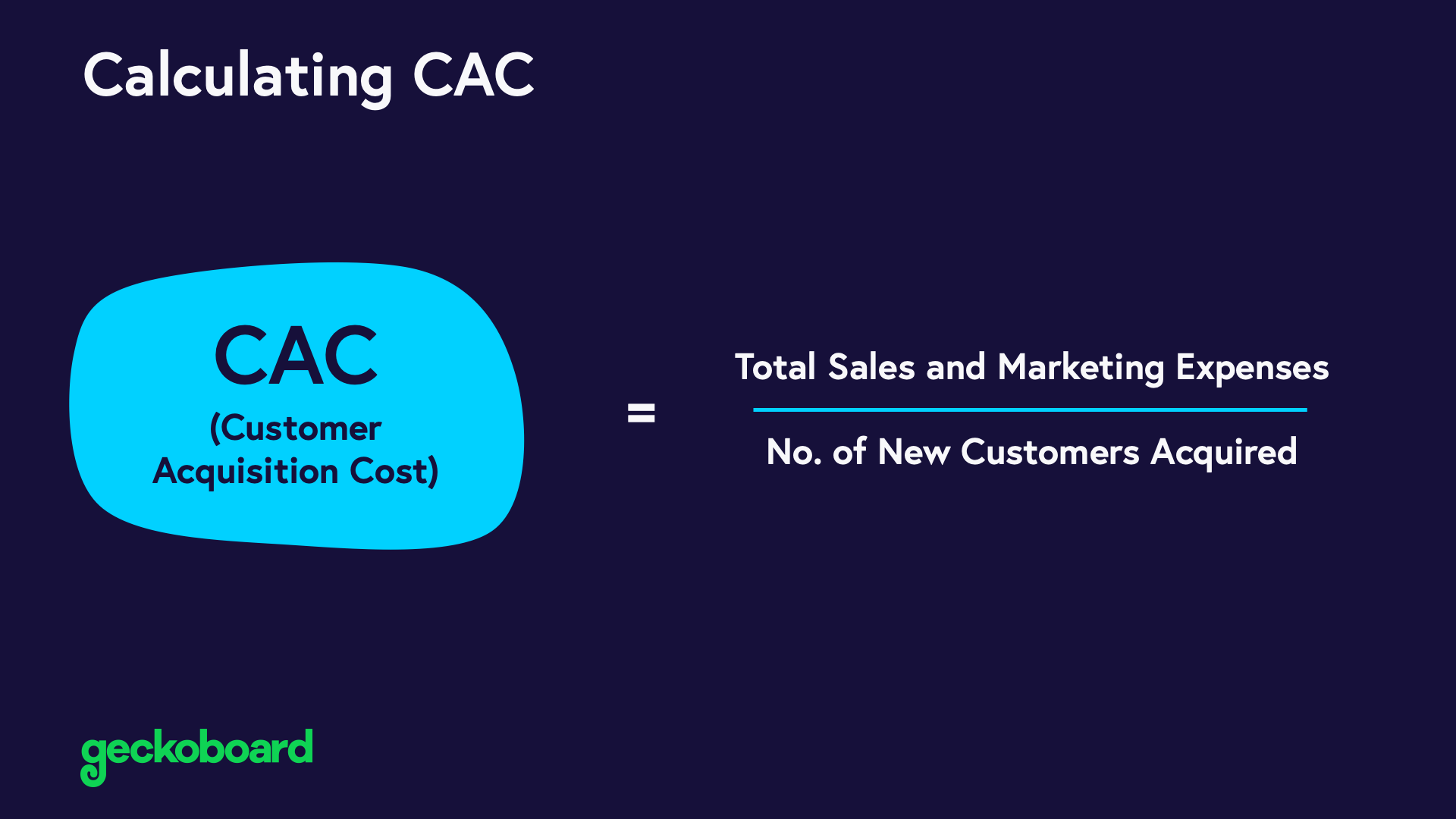

CAC Calculation:

($) Total sales and marketing expenses / (#) new customers acquired = ($) CAC

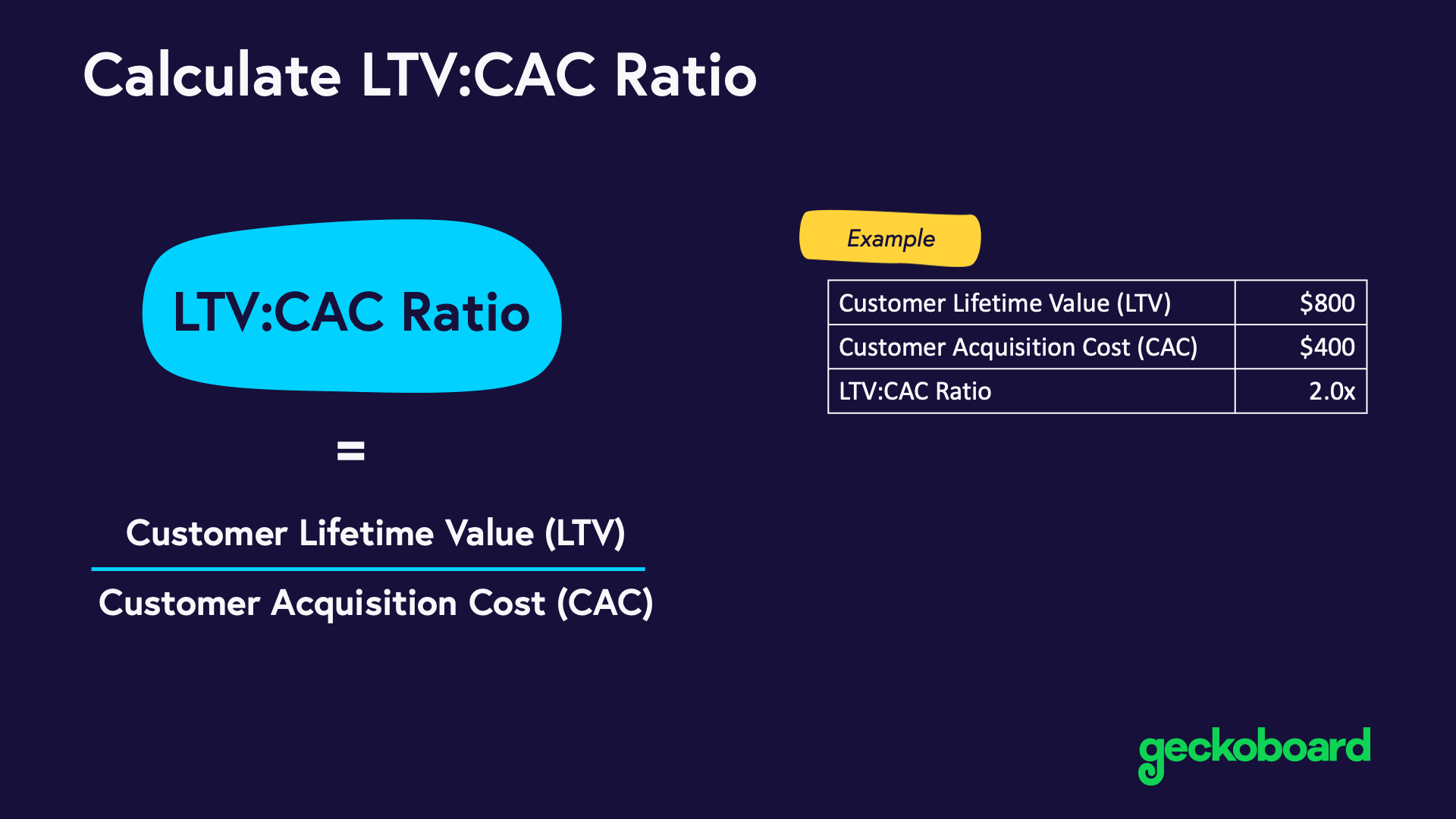

LTV to CAC Ratio Calculation:

($) LTV / ($) CAC = (#) LTV to (1) CAC Ratio

The average lifetime value of your customers is the average monthly revenue per customer adjusted for monthly churn and gross margin. You can also calculate LTV using annual recurring revenue and annual churn.

The cost of acquiring a customer is simply the sum of all marketing and sales expenses (including salary and overhead costs) over a given period divided by the number of new customers added during that same period.

Once you have both LTV and CAC calculated individually, it’s easy to find the ratio between them. Just divide LTV by CAC. For example, if your customer lifetime value is $3,000 and your expenses for acquiring a customer are $1,000, then your LTV:CAC ratio would be 3:1.

Pros:

Calculating your LTV:CAC ratio is a great way to see if your company is positioned for sustainable growth. This ratio acts as a barometer for determining how much or how little you should spend on marketing and/or sales to maximize your growth and stay ahead of the competition.

Cons:

The LTV:CAC ratio is a leading indicator that’s great for predicting future growth, but it’s a prediction that can easily change. For example, your LTV could drop if a new competitor enters the market driving up your churn. Or your LTV might increase if you make a really positive product change.

Relevant Marketing Metrics and KPIs:

If you’re adding LTV:CAC to your marketing dashboard, you might want to also consider tracking these related marketing metrics for context.

- Monthly Revenue Growth

- Customer Churn

- Customer Growth (# new customers month over month)

Industry Benchmarks

For growing SaaS companies, the industry standard for this ratio is 3X or higher - since a higher ratio means your sales and marketing have a higher ROI. However, higher is not always better. If the ratio is too high, you’re likely restraining your growth by under-spending and giving your competition an advantage.

A ratio of 1:1 means you lose money the more you sell. A good benchmark for LTV to CAC ratio is 3:1 or better. Generally, 4:1 or higher indicates a great business model. If your ratio is 5:1 or higher, you could be growing faster and are likely under-investing in marketing.

Additional Notes:

See this infographic for a more detailed calculation of ecommerce LTV.