CAC Payback Period

What is CAC Payback Period?

The SaaS Metric CAC Payback Period is the number of months it takes to earn back the money invested in acquiring customers. It shows your break even point. This metric often goes by Time to Recover CAC or Months to Recover CAC.

Advice from VCs: Why CAC Payback Period is critical

“CAC payback period determines how much cash the company needs to grow.” - Tom Tunguz, Partner at Redpoint Ventures

How to calculate CAC Payback Period:

($) CAC / [ ($) ARPA X (%) Gross Margin ] = (#) Months to Recover CAC

In order to calculate CAC Payback Period, you need to know three other key metrics: Customer Acquisition Cost (CAC), Average Revenue Per Account (ARPA), and Gross Margin percent. Divide the customer acquisition cost by the average revenue per account multiplied by gross margin percent. This gives you the number of months it takes to recover CAC.

Pros:

CAC Payback Period helps you know how much cash they need before turning a profit. It’s one of the best measures of capital efficiency for a SaaS company. The shorter the payback period is, the more profitable the company will be. Reducing the time to recover CAC also helps reduce the CAC that is lost from customers who churn.

Cons:

As with other key SaaS Metrics, Time to Payback CAC should be tracked in the context of relevant metrics such as Lifetime Value to Customer Acquisition Cost ratio (LTV:CAC).

Relevant SaaS Metrics and KPIs:

If you’re adding Time to Recover CAC to your SaaS dashboard, you might want to also consider tracking these related SaaS metrics for context.

- Customer Acquisition Cost (CAC)

- LTV:CAC Ratio

- Average Revenue Per Account (ARPA)

- Gross MRR Churn Rate

Industry Benchmarks

The general benchmark for startups to recover CAC is 12 months or less. High performing SaaS companies have an average CAC payback period of 5-7 months.

Larger enterprises can (and often do) have a longer CAC Payback Period since they have greater access to capital.

Additional Notes

“Many startups require 15 to 18 months to recoup the acquisition costs on a new customer, which puts an enormous strain on capital. Unless your investors are willing to keep pumping in cash, focus on keeping your CAC low enough to be recovered in a year.” - David Skok, General Partner at Matrix Partners

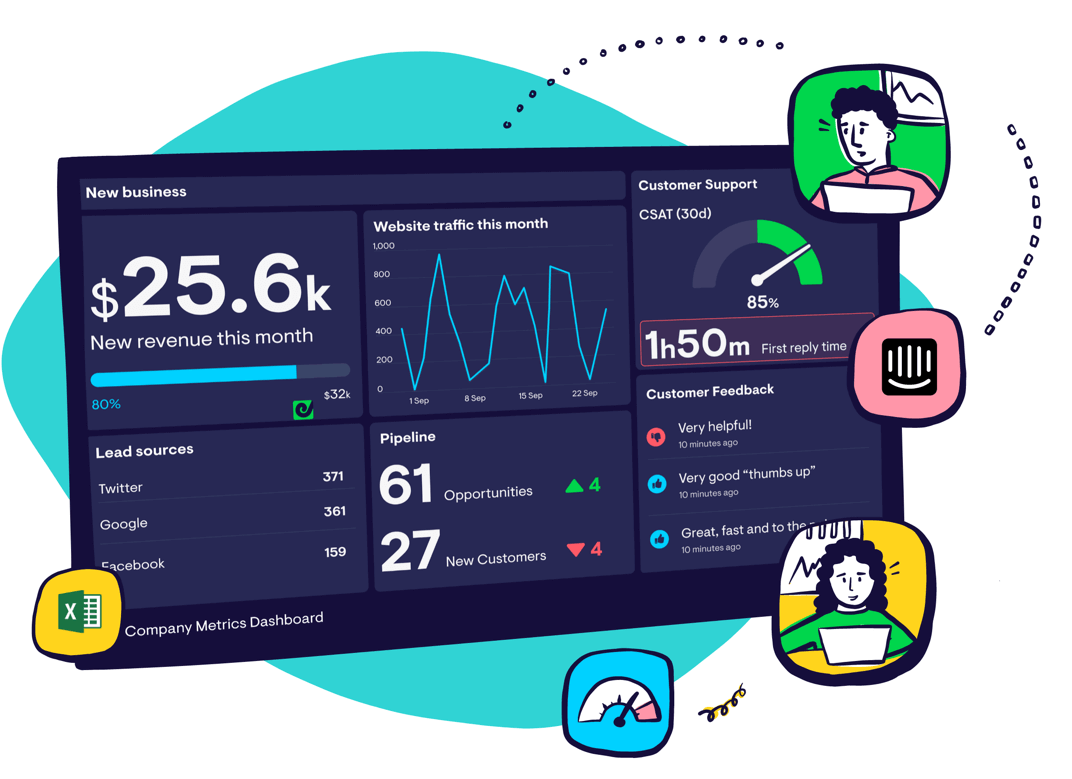

Want to create a SaaS dashboard using this metric? Check out this example SaaS Metric Dashboard.